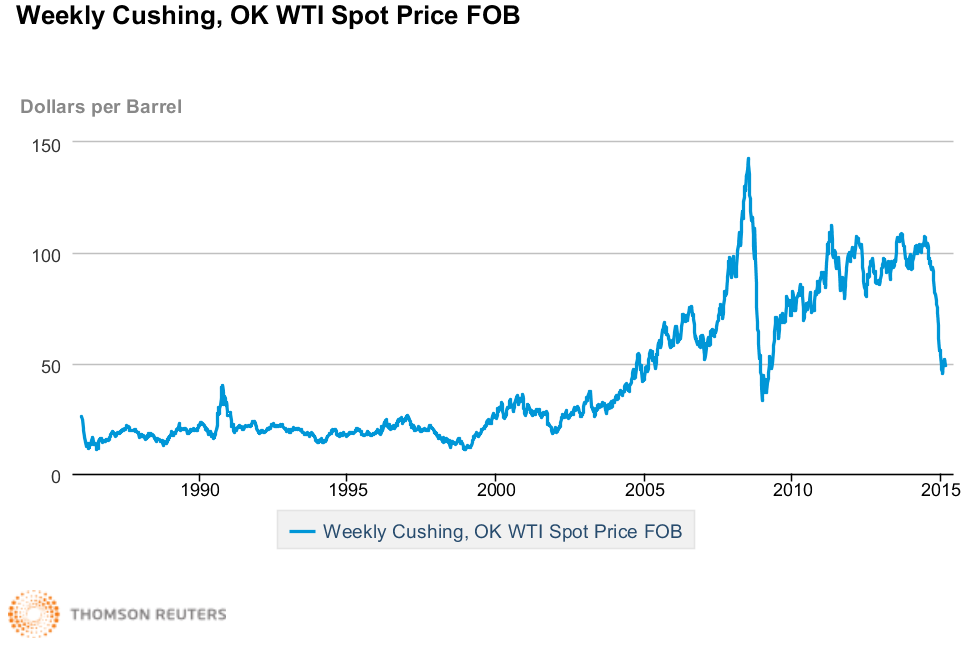

Right now you can’t go two days without reading about the low price of oil, oversupply, the economic implications, and forecasts for the future. With our large oil and gas sector, this is particularly true in Canada, and there have been plenty of “what does it mean for fusion?” questions coming our way.

The answer becomes obvious if you think broadly about our current energy system. Let’s look at a few factors:

- Climate change and carbon constraints haven’t changed. If anything, there is a growing realization that to keep climate change under control, we can’t consume the fossil fuel reserves we have already identified. This has major financial implications and strongly supports the drive to develop alternative energy sources that can scale globally.

Bank of England warns of huge financial risk from fossil fuel investments: The Guardian - Oil makes up only a small fraction of electricity generation, and hence oil prices affect transportation costs much more than they do the cost of electricity. From November 2013 to November 2014, despite a huge change in the price of oil, electricity prices in the US have remained largely unchanged (<4% variation).

Electric Power Monthly, February 2015: US Energy Information Administration

Globally, the critical opportunity is to economically displace coal-fired generation. Technologies with the potential to do that can certainly attract investment, regardless of the price of oil. - In 2014, as cold weather descended on the northeast, market (Henry Hub) natural gas prices rose quickly from $4.50 to $8.15 per mmbtu, but prices in New England spiked to over $30 per mmbtu, affecting electricity prices as well. Why? Pipeline capacity constraints – gas customers simply struggled to procure the fuel they needed.

Wilder weather swings are anticipated as a consequence of climate change, and the word “resilience” has emerged as an important theme in discussions around energy systems. Energy sources dependent on a continual supply of fuel from distant natural resources are inherently less resilient: supply lines are capacity constrained.

Henry Hub Natural Gas Price: US Energy Information Administration

Today in Energy, January 21, 2014: US Energy Information Administration

Beyond capacity, securing access to distant energy supplies can also be tremendously expensive, in human and economic terms (the US military has secured Persian Gulf oil supply lines at a cost of $7 trillion since 1976.)

Stern, Roger, “United States cost of military force projection in the Persian Gulf, 1976-2007”, Energy Policy, April 2010 - Finally, the health effects of fossil fuel consumption are significant. 7 million premature deaths per year are linked to air pollution, according to the WHO. This is a staggering number, both morally and economically.

7 million permature deaths annually linked to air pollution: World Health Organization

So, back to the question of whether last year’s drop in the price of oil is going to affect General Fusion and the need to develop fusion energy. Consider the above list: major economic, human, and environmental incentives to invest in energy innovation, yet not one of them is diminished by low oil prices. Carbon-free, clean, local (and resource-independent), resilient and cost-competitive energy is a colossal market opportunity.

But it’s not about the price of oil. It’s about the price of the planet.